Fractional

CFO Solutions

Is your business ready to get results like these?

GROSS PROFIT MARGIN IMPROVEMENT

NET MARGIN IMPROVMENT

BOOST IN YEAR-OVER-YEAR CASH FLOW

DEBT

REDUCTION

Elevate Beyond Basic Financial Management...

You Deserve More Than Just Financial Management You Deserve a Strategic Partner

Embrace wearing just one hat—the CEO hat—and lead with greater confidence.

Immerse yourself in a strategic partnership providing financial guardrails for your business.

Embrace the Strategic Partner You Truly Deserve!

Meet our Clients

CEO of Appliance Connection

"Working with Carlos over the past 4 years has been transformative for our business. From the start, his patient guidance and strategic teaching approach helped us navigate through financial challenges. We've not only paid off over 60% of our consumer debt but also transitioned from daily financial struggles to having retained earnings. Carlos played a crucial role in successfully guiding us through a complex business acquisition, offering sound advice every step of the way. Beyond financial consulting, he provides a levelheaded perspective that extends to various areas of our business, fostering personal and professional growth. Thanks to Carlos, our approach to managing the team is now driven by our hearts, not just dictated by account balances. His impact has been truly invaluable.

COO of Amber Electrical

"We have been with Carlos for over 3 years now, and it has been a game changer for our Company. His financial acumen and strategic insights have not only improved our bottom line but also streamlined our operations. Carlos is an invaluable asset to our leadership team, driving our success with unwavering dedication and expertise. His dedication to our core values and vision has allowed him to fit right in as a part of our team not only professionally but personally as he navigates the vision of a family-owned business."

Director and General Counsel at Doctors Express

“As the Managing Director of a mid-size company, I face the distinct challenge of ensuring financial stability whilst balancing multiple operational duties. Over the past 4 years, Carlos has consistently provided indispensable perspectives that have significantly streamlined our executive decision-making processes. The financial picture was quite scary as we entered the pandemic. However, with Carlos' guidance and trusted advice, we were able to successfully navigate the complex financial terrain and emerge as a stronger organization, without laying-off a single staff member. Carlos' continuous contribution and proficiency in financial and operational management are invaluable to our company's growth and stability"

CEO of Brazen Standard Hospitality

"I've been working with Carlos for 3+ years now and the most value Carlos has delivered is by helping our focus remain on big picture financials and how the day to day operations affect the bottom line. In terms of the impact his services have had on our business...I truly feel like we would not still be in business without his guidance. During COVID in 2020, our business in the hospitality industry was hit extremely hard. We were on the verge of financial failure. Through a lot of hard work we have pulled through and now are expecting to turn our biggest profit ever in 2024"

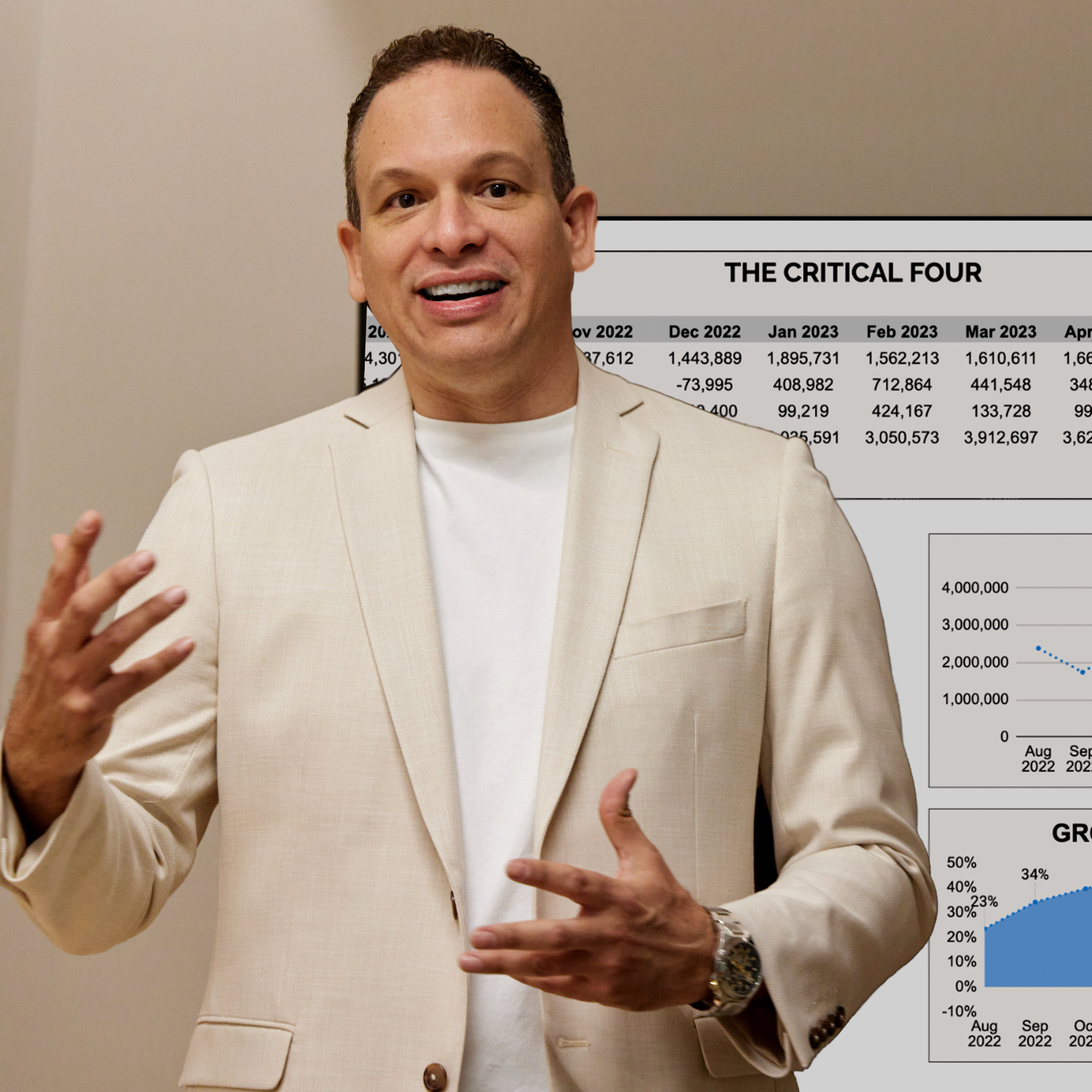

Nice to meet you

I'm Carlos Ramirez

OUR VISION

A steadfast commitment to provide business owners with crucial knowledge, tools, and strategic insights needed to confidently navigate today’s dynamic business landscape.

OUR MISSION

We don't stop at numbers; our mission is to guide your business into a thriving hub of profits and cash flows to powerfully transform and impact your business through our services.

You are ready for our services when..

- Your company is surging ahead, experiencing rapid growth.

- You aspire to diminish stress and chart a course for long-term profitability.

- You're poised to undergo exponential growth and assemble your dream team.

- You're ready to be a bold leader, confronting challenges and making decisive moves.

- Past experiences with financial experts have been unsatisfactory, and you seek a trustworthy partnership.

- Concerns about business instability due to rapid growth without proper financial systems keep you up at night.

Our Guarantee

Frequently Asked Questions

During our assessments, we may identify issues such as cash flow challenges,

inefficient processes, or strategic misalignment. We help address these issues by

providing tailored recommendations, implementing strategic initiatives, and

providing ongoing support and guidance to ensure sustainable improvement.

CFO services are crucial at every growth stage to prioritize financial health and plan

for sustained success.